-

Posts

13 -

Joined

ACStudio's Achievements

-

Right...banks are evil...I think we can all get on board with that. But what are you or anyone else doing about it? Is your retirement being managed by a financial institution? If so then you are fueling their endeavors. You are told that you need experts to manage your money. Need proof that they are not experts? Look no further my friend. Here is a simple test. Try to find a financial expert that is willing to manage your money and only get paid a percentage of their performance above risk free rates. The fact that they make money whether you do or not is all you need to know that you are being had. If any one of them actually had a way to add Alpha they would monetize it. All the money they spend on research and analysts is to avoid litigation not to add value. And who pays for all that lawsuit protection? Not them. All fees for everything are always passed on to the consumer and it's no different in the financial world. Any person who has managed to read this far into the paragraph is fully capable of managing their own money with a higher probability of profit and a lower risk profile than any financial adviser. I'm a buyer of every one of you. I would take your investment ideas over any so called expert any day. Seriously, throw me a trade idea, if its a liquid product with a derivatives market with some depth I'll trade it. Who else has ever done that, when has anyone said "I believe you know more about the stock market than any of the financial experts" and is willing to put their money on it? (The market closes at 4pm Eastern) Quick note on the part about stock and derivatives manipulation by the bank or anyone else. They've tried and they aren't that good at it. The market is way too big and efficient in the US for them to pull it off anymore. More money goes through SPY in the first 15 minutes of a low volume trading day than goes through Vegas in a year. Trust me they are happy managing your "dumb money" and collecting the fees.

-

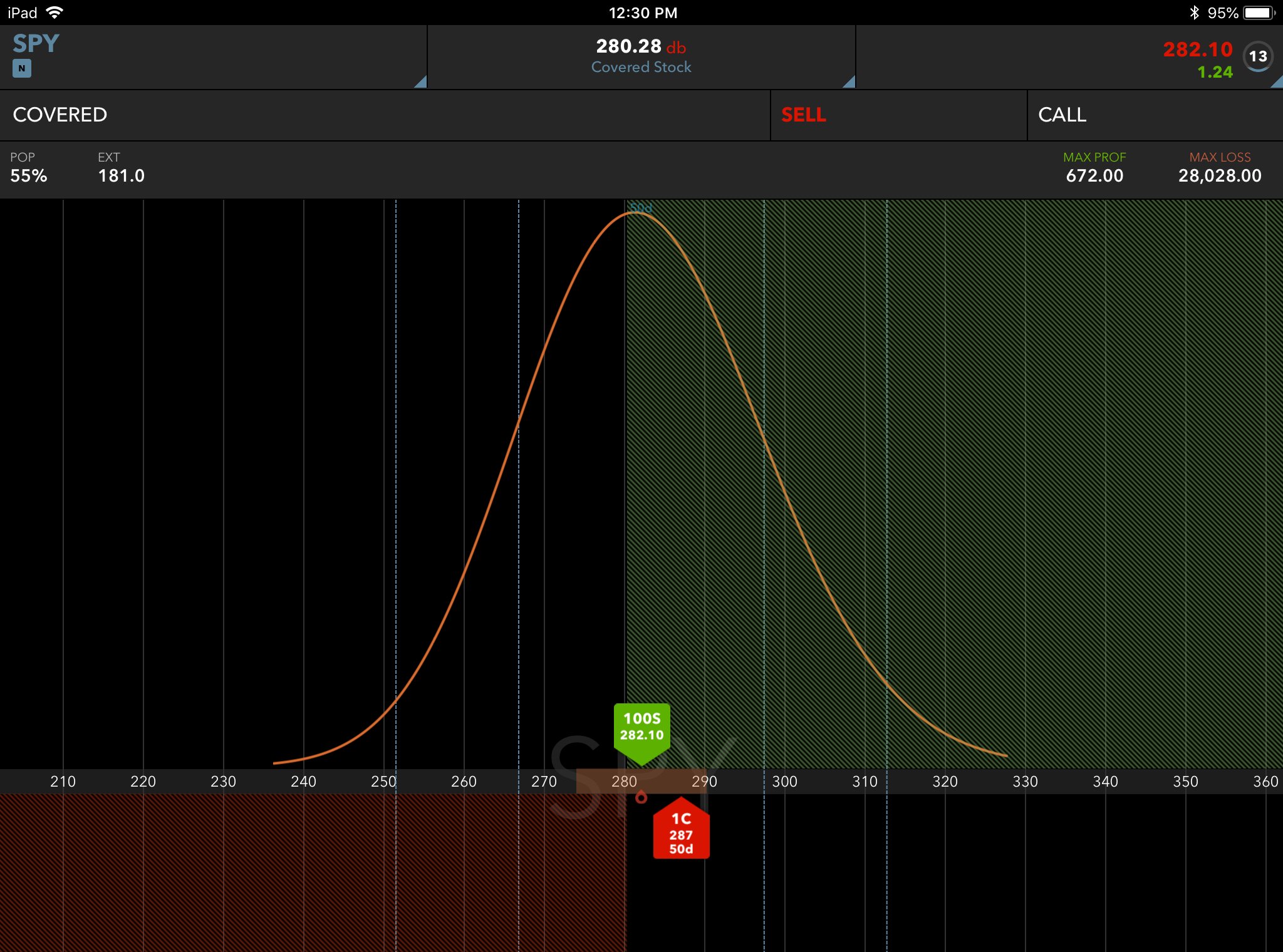

`Sounds good, it's always more interesting to have actual names of funds or stocks but that's enough. Say for instance your ag equip play is CAT (Caterpillar) and you want to hold for the long term here is how I look at it. Stock is trading around 150 and change, Implied Volatility Rank coming in at 40%, has earnings toward the end of Oct. I ignore the dividend at this point because I know every dividend stock has an ex-dividend date. Which means there is a day where the stock's price is adjusted down by the amount of the dividend to shareholders of record. Means that I will get credited the amount of the dividend but the value of the stock will drop by that price anyway so there is no arbitrage there. Also the price of the stock price has already taken into account the value of dividend returns over some period of time. Now lets say I own 100 shares in a self directed margin account that allows me to trade options. At this point I know the Delta risk of owning 100 shares of stock is 100. Means there is a one for one relationship between my position and the movement of the stock. So if the stock goes up 1$ I make 1$ per share and if it goes down 1$ I lose 1$ per share. My current probability of profit is 50%. The only way I can increase my probability of profit or reduce my risk is to sell something against it. So I look at the November options and see that the 30 Delta calls are trading for around 2.60. The 30 Delta calls fall at the 160 strike price. All this means is that the current implied volatility suggests that CAT only has around a 30% chance of being above 160 by Nov expiration. So if I sell the Nov 160 call against my 100 shares of stock I will be credited around 2.60 per share to my account (see covered call). This requires no additional capital but it reduces my cost basis of my purchase price by -2.60$. So if I bought the stock at 150 now I own it for 147.30. Since I now own the shares for cheaper than what they are trading for my probability of profit is around 60% for the next 45 days. I've reduced my risk, I've lowered my cost basis, now I just let it ride. I can later choose to manage the position however I want, but lets say I do this 10 times in a year and manage to keep 1.50$ of it each time on average I can easily reduce my cost basis by 15$ a share or more. At this point I no longer care what the stock is trading for...only that I can keep collecting that option premium against the capital it requires every month and generating at least 10% a year even if the stock goes sideways. If it continues up I make more if it drops I don't lose as much or maybe still make a little. This is how real investing works. It's no magic get rich quick secret. There is plenty of information out there about option premium selling and cost basis reduction. You just don't hear much about it because it's not glamorous and or complicated.

-

Always good to have some liquid savings. Not great for the long term when you are trying grow wealth or even to beat inflation. Metals/jewelry, sure why not. But again as a wealth growing asset class not any easy vehicle unless you’re in the business. The retirement fund is where I have strong opinions. My first problem with any such fund is simply return vs how much risk you are actually taking. Consider 2008. The average mutual fund was down 50%. Forget that the S/P was only down 40%. My question would be how do you lose 50% when there is no way in hell you will ever gain 50% over that same time span. Or even 30-40%. It doesn’t happen. Nowhere else in life would you take on the kind of risk that could generate a 40-50% loss without at least a chance of having that kind of gain. They have convinced the public that these are “safe” methods of hedging against inflation, accumulating wealth and you are supposed to be excited if you do 8-10% one year. But every 10-15 years the lambs are led to the slaughter and told, “you just have to ride it out, the market always comes back”. All the while they still make the payments on their yacht slip in the Hamptons. Learn to do it yourself, trust me you can make as good or better decisions than they can. If you don’t mind me asking, what fund is it? And not to judge your choice, I just am interested in what people are in as most of my discussions about finance are with self directed investors.

-

Excellent, I believe the subject would be worth a thread on its own or multiples where needed. Feel free to start a new one with specific topics and I'll jump in. I would but I have no way of knowing where everyone else is at. I've spent a considerable amount of time helping people where I could on trading forums but their questions are usually very specific. Probably the most important skill would be to learn to forget and/or not care. Forget everything you have probably been taught about finance...it's probably wrong or outdated, or both. I've had discussions with advisers fresh out of their series 7 exam who within 30 minutes of me showing them how real investors trade are questioning their life choices. Learn to not care what the monkeys are chattering about. In fact, learn to not care so much that eventually you will be so confident that you will know how do the opposite of anything anybody is telling you and in the end have a higher probability of success. Nothing makes me want to short something faster than if somebody tells me that some guru on CNBC said XYZ is going to the moon. It's OK to have opinions about the market...but realize that the market does not care about your or anyone else's opinion but you will know how to give yourself a higher probability of success either way. Some things to think about. Every mainstream financial outlet is conflicted. They are paid by advertisers...look at who their advertisers are. They aren't going to tell you how real traders operate. Because real traders do not care what somebody thinks. They understand that known information is priced into efficiently traded markets very quickly and therefore any particular long or short position only has a 50% probability of success from the time it fills. I decided to put on some financial news show at the shop a few months ago. Couple of guys were going back and forth about auto production in China. I watched the whole segment and not once did they talk about how that was actionable to the investor. I'm not sure they would even know how to trade it if they wanted to. I watched that bald guy with all the bells and whistles yelling "buy this" and "sell that". Hell, he got me fired up. But still I know the success of his predictions are going to be wrapped around 50% just like every other stock picker. Plot twist...I look at his pick and no way anybody with any sense would trade it...the bid/ask was .50 wide, volatility was at an all time low and daily volume had tumble weeds rolling through it. So yea, nobody knows anything about the future and what they do know is already priced in. Anyway, you've got most things sorted, knocked down the debt, bills are getting paid, Stefan's got you working on becoming a better person and questioning half the crap you've been fed as gospel since you were painting the walls with applesauce. Maybe you've put back some gold/silver. Got enough ammo to resupply the Nicaraguan revolution just in case Alex was right about the FEMA coming around. Now what? What about actually saving money for the possibility that you might end up on the front porch swing holding hands with the one you love watching the sun setting on your golden years. Or maybe you did the whole peaceful parenting thing and those kids turned out alright enough you might want to help them along. Well you know you can't stash all that G money under the mattress because the Gov is gonna inflate that down to nothing. And even though your slightly snobbish neighbor Chad seems to be doing alright with his fully funded 401 and works into the conversation, when he can, that it did a whopping 8% last year, you wonder. You wonder because it doesn't sit right knowing these big banks are sitting on a huge amount of private wealth and you know they would run over their mother to snatch up a fiver off the floor. And nowhere else in your life has it made sense to turn over something you worked so hard for to someone who gets paid whether they perform or not. Nowhere else in your life have you settled for mediocrity so why would you with what could be the biggest investment of your life. That financial adviser you met, Bryce something or other, seemed like a nice enough guy. But you know he's conflicted, he gets told every morning which fund he needs to be pushing if he wants to win that Caribbean cruise that his wife's been after him about. And even if he did have the best intentions the only vehicles available to him are what his firm offers so he may not even know about the soft dollar kick backs, embedded fees that are always passed on to the customer and any other matter of shenanigans that may be going on that are paid for with your money So whether you have any money or not you know that you would rather not do what everyone else is doing and you're ready to learn how finance really works. How to manage you own money like the professionals that you never even hear about do. Here's where you maybe start a new thread with some specific questions about where to start, I have some money I want to invest what now, I don't have any damn money but I want to learn, I think the market is crashing/flying how do I trade it, what's the probability of SPY being up/down 10% by Jan 1st, How do I short TSLA for the next 45 days using less than 500$ with a 75% probability of making money or anything else you can think of. Even if you think I'm full of old socks and need to have my head examined, hit me with whatever. Or continue with this thread if it seems to fit, just feel like I've raised the dead and highjacked a bit. In the meantime...a digestible bit of info? If you are going to understand finance you will need to build a vocabulary and you will need to understand options. Options are the only grey area of finance and by there very nature allow for building predictable risk/reward. But everything about fundamental and technical analysis is historic and therefore already priced in so don't worry so much about any of that, as everything you need to know a bout an asset is told by the current price. Nothing wrong with having an understanding but it won't make you money. Videos are good. You tube has some decent stuff. Don't trust anything with advertising or is trying to sell you something. Keep the questions coming.

-

Once you've ratholed enough supplies and metals to survive but not become a resource for the county, once you've learned how to run a trot line and skin a deer, once you've made friends with your neighbors Bryce and Kelsey who own a diesel generator, you are left with the possibility that one day you may be old and society may still be intact. Real estate, metals, Bitcoin, etc, are all good ideas but none are without risk any more than the stock market. They all can be lost one way or another. However in the stock market there is actually an efficiently traded market for the associated risk and fear. I wouldn't use a 401 or pension fund or whatever unless it was being matched by at least 25%. And even then I would seek to have it go into a self directed account. Your assertion that these things are a scam is absolutely correct. The scam is in that they claim they can add Alpha through their management while there is absolutely no data or evidence to suggest that they can with any predictability beyond what you would expect on a random bell curve of success and failure. Managing your own retirement account is far easier than the financial industry would like you to know. In the US the financial industry is something like 7-10% of the GDP depending on who you ask. They are strip mining everyone's retirement in ways you cannot even imagine and are doing nothing to add value. With the technology and fees available to the retail customer today there is no reason not to do it yourself. Forget about financial advisers, money managers, mutual funds etc. they don't know anything more than you do. And by doing it yourself not only can you outperform anything they can do you will learn lessons that will change your life forever. ps....To answer your questions more directly...no you are not stupid. And what am I doing? I have been self employed since '96. I manage my own money. I didn't start investing in the stock market until 2013. Since then I have learned more about money, risk reward and how the world really works than I ever thought there was to know. I trade mostly options and some stocks. But I am always selling option premium to reduce cost basis or to simply collect on premium decay. It is quantitative, strategic and predictable. Learning how to reduce cost basis with option decay is no magic secret. The markets are priced efficiently and I always know exactly where my risk is and that risk is predictable and manageable.

-

Yes I would agree that you would get exactly what you paid or sold for. What else would you get? But if by "zero sum game" one wanted to imply that there must be a loser in order for there to be a winner then I would disagree.

-

I couldn't disagree more. Forex is a different animal...but as for stock trading or investing it is everything but a zero-sum game. Proof=it is possible for two opposing positions to both get what they want. I could sell a put in SPY...the person on the other side of that trade might be simply buying it to reduce margin requirements on some other put position or to hedge off risk in another position. It is possible for both parties to be satisfied with the outcome. Yes money moves around...but it's not "just" moving around.

-

stocks/options Hmmm...what is success? Is it just P/L? Is it outperforming a long SPY position or outperforming a short SPY position. Is it outperforming your brother-in-law's IRA? Could it also be learning how to manage your own finances in a way that will make you a better decision maker for the rest of your life? Could success be getting your money away from the big bank machine and not paying someone for mediocre returns while creating a risk profile that you yourself would never agree to in any other aspect of your life? Insight 1 Nobody knows anything. Unless they are telling you they don't know, they don't know. Once you accept the fact that market pricing is efficient and that market direction is random (minus the positive drift of risk free rates) you will be free from the influence of all the chattering monkeys. "Efficient Market Hypothesis" in a nutshell suggests that all known information is priced into the market, and with today's technology this happens very quickly, usually within minutes or less. Insight 2 It's not gambling and it's not rigged. Proof= you get to choose which side of the table you want to be on. Unlike a casino where you can only take one side of a bet or the payout always favors the house. In an efficiently traded market with random price movement your odds on any particular naked stock position are always wrapped around 50/50 and you get to choose your order size, entry and exit. Insight 3 If you can book your own airline tickets online you can manage your own money. The fees available to the retail trader are as good and sometimes better than institutional traders and the front end technology is better than what most institutional traders use. Money managers for retirement funds etc are more concerned with litigation risk than whether you make money or not. They get paid either way and as long as they perform at some level near what everyone else did they will keep their jobs. There is no data or evidence to suggest that a financial adviser or money manager can add Alpha. Their success or failure is a random bell curve distribution and has nothing to do with knowing anything. Insight 4 Take all the charts, candlesticks, fibonacci lines, stock gurus, proprietary systems, black boxes, whatever and throw them all in the dumpster. There is no evidence that shows any of that has anything more than a random bell curve distribution of success and failure. Proof= if any of these things worked with anything greater than 50% reliability, someone with a whole lot more money than you and teams of MIT graduates working for them would have already soaked up the edge and it would be gone in 2 seconds. "So what's a new subscriber to do?" I'm glad you asked. Most of the big brokerages have pretty good front end technology that allows you to put through trades in a funded account. And most of these have some sort of "Paper Trading" feature that allows you to learn the technology in real time or with 15 minute delay so you can learn the technology. They usually have tutorials or videos to walk you through every step. Most of them allow you to create an account and do the paper trading without ever depositing any money. Now that your slingin stocks like a pit trading T-Rex...how do you overcome the 50/50 randomness of direction? You could just do like your adviser or money manager does and buy the age/risk tolerance appropriate percentage of indexes. X% of SPY,QQQ or IWM for stocks, X% of TLT for bonds, X% of GLD, SLV, USO for commodities, X% of EEM for emerging markets, etc etc. and let it sit until you retire or die. You'll at least outperform your neighbor Tim's IRA because you have no fees. But still you are basically riding the wave of randomness and maybe outperforming the inflation rate as long as the market stays positive and rides the positive drift of risk free rates. The one statistically proven thing you can do to increase your odds of success is to (ready for it?) cap your upside and reduce your cost basis. Every Bob, John and Cindy has a long position with unlimited upside potential. The problem with that is this...if your portfolio has the ability to gain 50% that means it also has the potential to lose 50%. So here is an example of what you can do to increase your probability of profit, say you are holding 100 shares of SPY (S and P etf) you bought at 292$ per share and sell the 295 call option that expires in around 45 days against it for 2$ and change which costs no additional capital. Now you own it for less than 290$ per share and now your probability of profit is wrapped around 60%. But you give up anything above that call you sold plus 2$. But you don't mind because you know that options pricing is based on probability models that are insanely accurate and as with any type of insurance (which is what they are in a way) the pricing tends to favor the seller (which is you). And although the options pricing model suggests that there is only 30% chance that SPY will be above 295$ in 45 days in practice it really closer to 25% which is the edge given to the seller as incentive for taking the risk and giving up the upside. To take it a step further maybe you do this 8-10 times in a year each time lowering your cost basis and your risk and always increasing your probability of profit. The above strategy is a "covered call" or "Buy-Write" strategy. It's not a secret or some magical thing. It is the first thing I would show anyone who is wanting to learn how to invest for themselves. There is much more one can do as you might guess but everything you need to know is on the internet and it's all free. I'm happy to discuss anything related...feel free to ask.

-

Libertarian POV on Inside Trading

ACStudio replied to Jsbrads's topic in Libertarianism, Anarchism and Economics

The LLC can have insurance on their autos and other insurance types. Also what you have described sounds like a "close corporation" https://www.law.cornell.edu/wex/close_corporation which doesn't always shield owners from liability, see "piercing corporate veil" https://www.law.cornell.edu/wex/piercing_the_corporate_veil obviously not my area of expertise but a quick google search shows some free market solutions. One could create a million "what if" scenarios but these things can usually be sorted out without coercive force.- 19 replies

-

- libertarian

- inside trading

-

(and 3 more)

Tagged with:

-

Libertarian POV on Inside Trading

ACStudio replied to Jsbrads's topic in Libertarianism, Anarchism and Economics

If I understand your question correctly, yes. The link I provided shows the time and quantities of the fills for TSLA. Or you can watch in real time on most retail trading platforms. But to put it simply, the concern someone would have trying to cheat their client is that if they fill an order and bill it at a price higher than what it trades at for the rest of the day then the client can easily calculate that they have been had. To take it a step further my concern with that scenario lies with why a person is phoning in an order and paying a huge vig for a broker assisted trade. Quick story. I was talking to a guy the other day who fancies himself a pretty savvy investor because he keeps up to date on all the hot gurus and his long/long portfolio has made him feel like the Wolf of Main St along with every other genius that happened to have their sails at full mast when the winds blew their way. And something he said caught my attention. It almost sounded like he said he called his guy. “I’m sorry, who did you call?” I asked. He was calling his broker to make stock purchases. So I pull out my fancy 4 year old iPhone barely protected by a not so life-proof case and 6 button pushes later I show him the same order put through on my phone and it’s 5$ to execute, round trip. He’s pushing the outside of 74 so his eyes glaze over like I just flashed him schematics for a night landing on a Russian aircraft carrier but now he’s interested enough now to turn up his hearing aid and start a game of 20 questions. The point of the story is this. With the technology available today there is no reason to pay a someone to handle your investments. There is no data to suggest that financial experts add Alpha yet they soak up 7-12% of our GDP depending on who you ask. We are forced to find ways to protect our money from inflation taxation then told it takes an expert to do so despite the fact that none of them have any idea of how to add value as their primary concern is billing the customer and avoiding litigation...not helping the consumer.- 19 replies

-

- libertarian

- inside trading

-

(and 3 more)

Tagged with:

-

Libertarian POV on Inside Trading

ACStudio replied to Jsbrads's topic in Libertarianism, Anarchism and Economics

IOC is just a time frame designation for an order type so I'm not sure how that enters into it. But to answer your question...assuming there is 100k liquidity offered at 419.70 and you can get filled at that price the customer will remember you by name next time they talk to your boss and maybe you get that bonus to buy granny that Trans Am she's been hinting about or be a next step player and pick up that custom 2 button navy from Jorge, who pronounces it "nahhvy", down on the Ave that really sets off that power tie you been ratholin' for a special day. And let me tell you why. Because if you sell them your inventory at 420 or bill the fill at 420 and the stock never trades 100k at 420 the company will get a phone call or have a lawsuit on their hands from an angry customer and you will most likely lose your job and be lucky to be selling timeshares in Florida to a couple of newlyweds named Bryce and Lacey by next spring. Times, fills and quantities are all public knowledge. https://www.nasdaq.com/symbol/tsla/time-sales I'm not suggesting it never happens but free market solutions are already in place to protect the consumer. The transparency and technology available to the retail customer has never been better than it is right now. I would suggest that every person who has the mental capacity to create an acct and post on this forum is more than equipped to manage their own investments. Anybody that tells you they can do it better than you is trying to sell you something. I'm here to liberate the masses from financial anxiety and chew bubblegum....and I'm all outta bubblegum.- 19 replies

-

- libertarian

- inside trading

-

(and 3 more)

Tagged with:

-

Libertarian POV on Inside Trading

ACStudio replied to Jsbrads's topic in Libertarianism, Anarchism and Economics

Of course getting rich is the intention, but the risk is still there. If I buy or sell enough shares to move the price of a stock there is no guarantee that it will stay there or that the liquidity will even be available to close them out for profit. The risk is still there just like anybody else. And the fact that there is somebody willing to take the other side of that position is the proof. If it was a risk free trade there would be no taker on the other side. The counter party to any action like that has the ability to spread off the risk to an extent but risk is still there for everyone involved. IOC (immediate or cancel) is a TIF (time in force) designation. Not sure what that has to do with price improvement for retail traders but I'm happy to discuss it.- 19 replies

-

- libertarian

- inside trading

-

(and 3 more)

Tagged with:

-

Libertarian POV on Inside Trading

ACStudio replied to Jsbrads's topic in Libertarianism, Anarchism and Economics

Not necessarily, often shares or options held by board members or other insiders are on a lock up and can't be liquidated until some certain date and everybody knows what that date is. But for positions not locked they still have to file with SEC if they are buying or selling stock or options above a certain number. And that is public knowledge as well...you can view all filings from any number of websites and the EDGAR tools on the SEC website. Then you have the problem of liquidity. Just because you have 1 million shares of XYZ it doesn't mean you can walk over to your bloomberg terminal and hit the bid and get a fill. You would want to find a buyer or buyers to take the other side of the action...often a bank or some entity that can take the position and spread off the risk without ever going through an exchange. So in reality the small stock holder or worker can be far more nimble. Not suggesting it doesn't happen occasionally on some scale but it's not as easy as it sounds. Markets makers are incentivized to make markets, but are not required. Just to be clear. Because you are offering 100 shares of XYZ at a price, and it may be the best price across the exchanges, doesn't mean you will get a fill. If the market moves away from your price because there are no sellers you will not be filled until you either change your price or the market comes back. They may or may not want to unload inventory, For examples see any "flash crash" when the market makers just stepped aside. That's not really front running in the true sense but anyway, the reason nobody cares is because if you call your bank and put in a "market order" for 100 shares of XYZ instead of a "limit order" you don't get to complain about your fill. You'll be lucky if you get filled at anything under the high of the day. And if they are selling you their inventory who cares...all you should care about is your fill price. And that can be determined by you using a "limit order". A fair question for anyone with 2 brain cells. But for someone who actually trades it is of no concern. GS couldn't manipulate something if they wanted to. More notional value goes through S/P in the first 15 minutes of an average day than goes through Vegas in a year. The only stocks, futures or ETF's big enough for them to want to manipulate are so efficiently traded that even if they they could push the bids up for a couple of minutes the risk is still there and they could lose like anybody else. And forget about "front running". Nobody is going to front run your market order for 100 shares. They can't. Self directed investors who use market orders and get filled, get price improvement about 30% of the time for stocks and around 25% of the time for options. That means that 30% of the stock "market orders" to buy a stock get it cheaper than they were willing to pay, and the same for sellers. This is a direct result of high frequency traders or market makers or liquidity providers...whatever you want to call them. They are being demonized by the likes of GS, BOA,etc because they do not favor the big guy trying to get filled on 100,000 share lot of AMZN. Most brokerages do not inventory stock. It's a "fill em and bill em" business model. If your brokerage does inventory stock (there are a few that do I guess) Then I'm not sure it would matter as long as you got filled at your price or better. And as far as their opinion on whether it will go down or not...who cares? Trust me, no one knows what any of these stocks are going to do. What they believe is irrelevant, in fact I'll pretty much take the other side of what anybody wants to do because that's how sure I am that "nobody knows nuthin'"- 19 replies

-

- libertarian

- inside trading

-

(and 3 more)

Tagged with: