Search the Community

Showing results for tags 'insurance'.

-

I just got a letter from the company that insure my car. They have given me a quote for another year of insurance. Their quote included the following sentence: Oh really?! There's a thing called "insurance premium tax" which I have apparently already been paying for via artificially increased insurance rates... and also... it has just been arbitrarily increased! * shakes head in disbelief * Amazing. So this is how it works: people in government decide they want more money to spend on things that they want. Those people in government then increase the amount of protection money they charge me (and the rest of us) so rather than me spend my money on what I want... they get to spend my money on what they want. This is how people want their society to be run? I will obviously being paying up because... it's not a request... it's a demand, backed by threat of extreme violence. Also: they target all companies that provide car insurance so there likely isn't even an option which doesn't involve... [looks back down at the quote]... "insurance premium tax". I've tried to explain to the sheeple that support this stuff that they are supporting and advocating theft on a grand scale. The sheeple invariably tell me (in an apparent attempt to rebut my claim) that "we need to be stolen from by the government because otherwise there would be chaos... and bad people would steal from us!" They actually, usually say "we need to be taxed", but I've got used to silently converting "taxed" to "stolen from" in my head because I'm not aware of any functional difference between the two words and propaganda makes my head hurt. They actually, also usually say "because there would be anarchy", but I've got used to silently converting "anarchy" to "chaos" in my head because it makes their insane statements just slightly less insane. It provides me a slightly less painful cranial experience. I guess this is just a rant. Hope you don't mind. I have literally no one in my life that understands and accepts this stuff.

-

Hello! fellow Philosophers. EDIT: To be perfectly clear, I do not endorse Bitnation. I only mention it as an example of people working on decentralized insurance companies among other things, Decentralized insurance or DDROs are my only interest in Bitnation right now. And it is their essense that intrigues me not the means in which they may be applied, atleast at this time. There's a topic that I've wanted to bring to your attention for a while now and I'm exited to say the time has come. I'm not sure how familiar all of you are with the Bitcoin technology, but I believe it has the power to speed hack us to a free-er society in a variety of ways. For those that are not familiar with the back end of Bitcoin. Bitcoin is a long list of every transaction that has ever been made, this transactions can carry anything from information about who owns what coin, to digital files that represent things in the real world. A google maps image of your house for example can be "hashed" and turned into a unique set of digits that once added to the blockchain along side a hash of a contract signed could prove transferred ownership of the house. This ledger is distributed among computers all over the world and in multiple jurisdictions and it is updated live. For a variety of reasons that I can get into if people are skeptical, Bitcoin's technology makes fraud very very very difficult. It also allows for what have been dubbed DAO's or decentralized autonomous organizations. This simply put means that one can create a program that runs ontop of blockchain networks and can not be destroyed or ended by any one party, since there is no central point of failure. The internet would have to be shut down, to kill Bitcoin and that which is being built ontop of it. The reason I mention all this, is because there are a few projects gaining strength that may allow for what could be decentralized, jurisdiction and bureaucracy free insurance companies. And if I remember correctly, insurance companies are essentially what DROs are, according to stef's DRO theory. I'll be writing an article about this topic during the next week or so that I'll be aiming to post on Bitcoin Magazine and will be interviewing someone deeply involved in Crypto currencies and insurance. But I also wanted to get your thoughts on this subject. If we had the possibility of having insurance companies that are not subject to government power. Than can we begin to build the anarchist heaven that we have dreamt of, ontop of the internet? Here is one project in particular that claims to know how to do something like this. Though I am skeptical of many of the claims they make, bitcoin insurance seems to me very possible and within our grasp. http://www.bitnation.co/ I can elaborate more or anything if you wish. I have not looked into DRO theory in a while though, so this is part of the research for the article. My question is. If we can create insurance companies ontop of the internet, with their headquarters being a website distributed throughout the world, and with its core members being anonymous. And if we can find ways to have users of insurance prove to these organization when damage to insure property has happened, than do DRO's come to life? How is government able to control and diminish the power of insurance today and why are DROs not currently alive? What would be the limitations of such a system, given that peaceful parenting has not yet become mainstream? Thank you. I look forward to your thoughts. (PS: trying to find the right forum for this post has resulted in my posting it in 2 different sub forums here, sorry for spam)

-

This is a followup to some ideas I outlined in this post. I started thinking about this in terms of a stateless society and DRO's, but I realized it might even work in the current statist system (though the govt likely would have to allow it as they've got incentives not to)...is this a good idea? a terrible idea? am I missing something? any feedback would be appreciated Disputes arising from unintended pregnancy, putting your money where your mouth is. People take risks. Smart people mitigate those risks, insurance is a common approach. Unintended pregnancy is one of the risks many take, and the consequences can be devastating -- emotionally, spiritually, and financially. What if this risk, too, could be mitigated through voluntary contractual obligations, unintended pregnancy insurance? Below I've outlined, in a simplistic way, two "insurance plans" and the various ways that disputes could arise -- and be resolved -- between participants of those plans should an unintended pregnancy occur. These insurance plans could provide incentives for people to make better choices with regard to sex partners and could provide leverage to "get your way" in any disputes that arise. Being contract-based they're likely to hold more weight in court -- should things come to that -- as it's not just a "he said, she said" situation, but rather a contractual obligation. If such a system were widely adopted, people could use inter-group sexual ostracism to further mitigate their risks. Sure, some people will always be irresponsible, but wouldn't it be great if you could just check the "insurance card" of a potential partner and *know* that your values align? The plans: Plan A - (A for abortion) prefers kids be aborted, or A(d)opted Plan B - (B for baby) prefers kids not be aborted Plan A gives discounts for birth control use, biggest discount for long-lasting injection-type. Also gives discounts for time without a claim. An optional additional premium goes toward incentivizing adoption over abortion, let's call this Plan A(d). Plan B gives discounts only for time without a claim. The players: Manny the man-whore and Suzy the floozy are both on plan-a, they've agreed ahead of time that they do not wish to be responsible for their children and have insurance to cover contingencies. Manny has plan A(d), he doesn't want any children but would prefer his progeny be adopted over aborted. Suzy doesn't want to be tied down with the complications of pregnancy at all and therefore has plan A. Sally the saint and Mark the moralist are both on plan-b, they would prefer that even unintentional pregnancies be carried to term. Irene and Ivan are both irresponsible, they have no "abortion insurance" at all. Vance and Veronica don't want any kids, ever, so they've chosen vasectomy and tubal ligation, respectively. They don't have to worry about any of this. The scenarios: Note that payouts/incentives would be an effect of the "level" of insurance one carries, if one party has a $500k policy and the other has a $50k policy, the one with a higher level of coverage is going to have much more leverage. So, what happens when we mix up these variations of preference in the sexual arena, and unintended pregnancies result? Let's explore some of the possibilities. I) Manny unintentionally impregnates Sally. Manny does not want to be responsible for his progeny, he doesn't want children, and he's got insurance to mitigate the financial impact of his poor decision making. Sally refuses to abort the child and has insurance to mitigate the financial impact. In this case Plan A and Plan B underwriters get together and come up with the following options: 1 - Sally can be paid (by plan A(d), Manny's insurer) to abort the child. 2 - Sally can choose to release Manny from any liability, for appropriate compensation, and to carry out the pregnancy and either - a) keep the child. b) give up the child for adoption and receive additional compensation in accordance with Manny's coverage. 3 - Sally can opt out entirely, losing her insurance coverage, and go the "traditional" route of suing Manny for support. II) Manny unintentionally impregnates Suzy. They've both agreed ahead of time that they do not wish to be responsible for their children...these are Suzy's options: 1 - Suzy can have an abortion, paid for by Manny's insurer. 2 - Suzy can choose to release Manny and their insurers from any liability and carry out the pregnancy and either -- a) keep the child. b) give up the child for adoption and receive additional compensation from Manny's plan A(d) coverage. 3 - Suzy can opt out entirely, losing her insurance coverage, and go the "traditional" route of suing Manny for support, her case will likely be thrown out of court as she's already signed agreements not to do this. III) Manny unintentionally impregnates Irene. Manny is insured, Irene is not. These are Irene's options: 1 - Irene can abort, Manny's insurance will cover part of the expense. 2 - Irene can carry the child to term and either - a) keep the child, releasing Manny and his insurer from liability. b) give up the child for adoption and receive compensation from Manny's insurer. 3 - Irene can follow the "traditional" court-based route. IV) Mark ("the moralist") unintentionally impregnates Sally. They both prefer their progeny not be aborted. These are Sally's options: 1 - Sally can carry the child to term, receive compensation from Mark's insurance and either - a) keep the child. b) give the child up for adoption (possibly to Mark.) 2 - Sally can keep the child and follow the traditional route. 3 - Sally can, at her own expense, abort the child. She will likely be dropped from her insurance coverage or her rates will increase significantly. V) Mark unintentionally impregnates Suzy, the options for Suzy are much the same as II above, varying only in regard to compensation for the various options (i.e. Mark's insurance will not pay for an abortion and will offer incentives to carry out the pregnancy.) VI) Mark unintentionally impregnates Irene. Mark is insured, Irene is not. These are Irene's options: 1 - Irene can abort, at her own expense. 2 - Irene can carry the child to term and either - a) keep the child and release Mark and his insurer from liability for just compensation. b) give up the child for adoption and receive compensation from Mark's insurer. 3 - Irene can follow the "traditional" court-based route. VII) Ivan unintentionally impregnates Irene. Neither are insured. Irene's options are: 1 - no different than they are today.

-

Good Evening FDR!This is my first time writing here mainly becuase i didn't know what to start writing about.But now I have a problem that need some philosophy applied.I inherited money when my grandfather passed away, about 20 years ago, the money was placed in a trustfund.In mid 2009 my stepfather faked my signature and managed to get the money wired to his account.I noticed this 3 weeks ago.The bank now tells me that they are not responsible for verifying signatures or control who's account is being listed and that i should contact the police and press charges.I feel that they have a responsibility to me, as their customer, and that they should restore the funds by the value that they would have today.What I need help with is to sort out who is actually responsible and why.And if is the trustfund then i could use some strong logical arguments that can help me battle the suits.I can definitely provide you with more information if you need it.I'm not sure what information is relevant so this is just what I think is essential.Thanks in advance/L

-

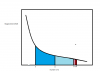

Recently Obama tried weasal out of his lie that "You can keep your plan, period." by claiming that he was helping the "Underinsured" by making them lose their crappy plans. Allegedly there are all these people in America that haven't bought enough insurance and he'll fix that by making them buy enough. Yes it's the standard paternalist claptrap, we know better because you're a five year old. However because these people can't actually imagine someone else's situation I'm going to give them a theorectical understanding of why To understand why underinsurance makes sense for a lot of people let's look at why people want insurance at all. People want insurance because the financial loss from a disaster causes more dissatisfaction per dollar than the financial losses from paying premiums. We know this is true because policy holders pay more on average than they recieve in claims (absent idiotic government mandates to insure people at a loss). So they don't expect more money, yet they expect more value (otherwise they wouldn't do it) on average. So why would some dollars be more valuable than others? This is due to the "Law of Returns" that says the more you have of a resource the less valuable each additional unit of it is. Consequently the LESS you have the more valuable each unit of that thing is. In the event of a catastrophic event like your house burning down, a health problem that requires expensive surgery etc. you have lost things worth a lot of $, so you effectively lack a lot of $. Therefore each $ is worth more. While before that you have (relatively) a lot of $ so each one is worth less. Therefore it makes sense to sacrifice a lot of $ in premiums for a small average number of dollars in post-disaster dollars. Consider the accompanying graph. Point A is your income without paying premiums. Point B is your income minus partial premiums and point C is your income paying full premiums that make good all losses in the event of whatever you're insuring against. Point D is where you are if you have a disaster and are only partly covered, "underinsured" in Obama's terms. Point E is where you are if you are totally uncovered in the event of a disaster. Notice how the majority of the benefit of being covered (the dark blue area under the curve from D to E) is provided by only partial insurance. The benefits from being fully as opposed to partly insured is the light blue area. Notice also that the pink area representing the additional cost of full premiums is larger than the red area of paying partial premiums. That's because what you give up to pay the extra premiums is more valuable than what you give up to pay the basic premiums. That's because you give up buying less valuable things first, that's how you know you consider them less valuable. So say you insure your house would cost $100,000 to replace it it burnt down. Suppose also that you could afford to pay for $50,000 of the cost of rebuilding your house, either from savings or from making loans at reasonable rates. You no premiums and if your house burns down you have to spend money on rental accommodation until you scrape up the money. Maybe you even give up on owning a house and sell the land (maybe in a buyers market, since you don't know when your house will burn down). Or you could pay for a $100,000 policy and if your house burns down the cost is minimal (other than the sentimental value of heirlooms etc). I'm assuming here everyone gets out safely BTW. Or you could get a $50,000 policy and if your house burns down you can rebuild, but you have to work overtime to pay off the loan, the holidays for the next few years are at your sister's place etc. The middle course obviously avoids the majority of the harm of a fire, while only costing half the cost of full insurance. That doesn't mean that everyone is better off underinsuring, it depends on how you value the various outcomes. It does mean that it is possible to want insurance and not full insurance, so "under-insurance" can make sense for some people. Of course there is additionally the fact that people who underinsure are sometimes lower risks on average. For instance if you know that you are unlikely to have a car crash (because you don't drive much) you might be more likely to underinsure. If this is true in a market then under-insurers might get a better deal from insurance firms who know the risk of insuring them is lower. However whenever I've heard of "under-insurance" on the news it's always presented as a bad thing, whether by the Obama team who criticize other's healthcare choices or in bushfire season, where fire insurance executives will often warn of under-insurance. Don't listen to them. If you want to under-insure, do it. EDIT: Just click on the attached thumbnail to get the picture to a reasonable size.